KEY:

I: Interviewer Dr. Ivano Cardinale

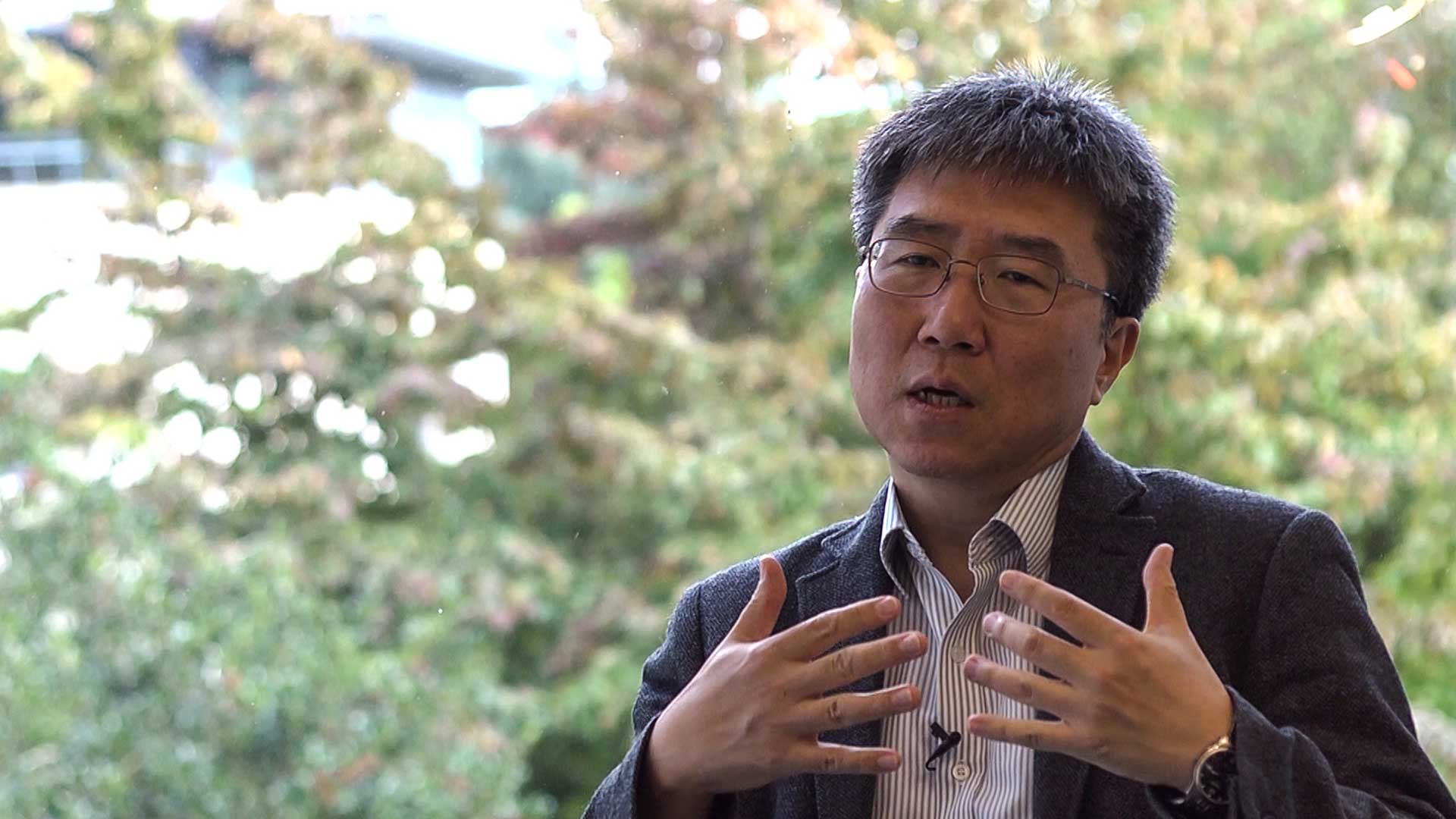

HJC: Ha-Joon Chang

I: We are with Ha-Joon Chang, Reader in the Faculty of Economics and Director of the Centre of Development Studies at the University of Cambridge. Ha-Joon, thank you for agreeing to participate in this interview series organised by Economics at Goldsmiths and the Independent Social Research Foundation.

HJC: Thank you for inviting me.

I: I’d like to start the interview from the area of economics to which you have devoted much of your work—economic development. Is there a consensus on the definition of economic development, or are there competing definitions?

HJC: Oh, yes. People have debated about the definition for ages. Now, broadly, there are, I think, two-and-a-half definitions, if I may say so. The first definition is basically conflating economic development with economic growth. So as output per capita grows, there is economic development. This view is adopted by most neoclassical economists, who form the vast majority of the economic profession today. But then there is another definition, which has roots from the classical school and the Marxist school and also what I call the developmentalist tradition, people like Alexander Hamilton, Friedrich List, and the development economists of the 1950s and ‘60s, people like Simon Kuznets, Albert Hirschman and so on. In these alternative traditions, economic development is defined not purely in terms of quantitative growth but qualitative change.

This definition is based on the understanding of the economy mainly as something based in the sphere of production. So, for these people, economic development happens only when there is fundamental structural transformation in the productive structure of the economy and also the underlying capabilities that make that productive transformation possible. It’s a much more nuanced and qualitative definition of economic development. For example, Equatorial Guinea, which is actually, at the moment, the richest country in Africa, because of oil, grew from an economy with $350 per capita income in the early ‘90s to a country with something like $22,000 per capita income. The standard neoclassical definition will classify this as economic development but there are people like Albert Hirschman or Friedrich List who would say, ‘No. That’s not development. That’s just quantitative growth.’

Then I said two-and-a-half definitions because there has been more recently a variant of the neoclassical definition, which is apparently more progressive, but in the end even less forward-looking than the standard neoclassical definition. This is a definition that more or less equates economic development with poverty reduction. Now, the height of this definition was the so-called the Millennium Development Goals of the United Nations launched in the year 2000, and in this definition, well, they had different elements but basically, economic development was equated with poverty reduction. So this is an even less comprehensive definition than the standard neoclassical definition. However, a lot of people subscribed to it because it was advancing this progressive agenda. It was, like, ‘If we are growing quantitatively but not reducing poverty, can we call that economic development?’

So it has a progressive element, but, on the other hand, this is a vision of the economy as something that is almost static. You don't need structural transformation. You don't need growth in productive capabilities. All you need is to generate more income and, more importantly, redistribute it more fairly so that we eliminate abject poverty, which is usually defined as $2 a day. So that is a very narrow defensive kind of definition. This is not strictly speaking the same as the neoclassical definition, but it is quite strongly linked to it because it is mainly about people as consumers, what kind of incomes they have. It is not about the transformation of the productive structure. It is not about people taking up different professions, turning themselves from subsistence farmers into manufacturing workers and so on. So, in that sense, it’s rooted in the same world view as neoclassical economics.

I: That’s very interesting. Your answer seems to suggest that different economic schools have different definitions of development, which might lead to different policies. Could such definitions and policies be so much in contrast that pursuing development as defined by one school might hinder development as defined by another school? For example, it seems that you suggest that poverty reduction might actually hinder the transformation of productive structure.

HJC: That’s right, yes. It is not just academic theoretical differences because they give very different policy implications. So if you take what I call the productivist view, the view that economic development is in the transformation of the productive sphere, yes, then you will necessarily recommend economic policies that will encourage the accumulation of new technologies, acquisition of new skills by workers, transformation of the social arrangements to back those. So the most famous policy recommendation in this tradition is the so-called infant industry argument. The argument that governments of economically-backward nations need to provide trade protectionism, subsidies and other supports to young industries so that they can have the space to develop their productive capabilities and eventually catch up with the more advanced producers from abroad.

Now, for this to happen, you would need to provide tariff protection. You might even need to ban the imports of certain foreign products. You might put restrictions on foreign direct investment. You might set up state-owned enterprises in the large capital-intensive sectors with high risk because, typically, in developing countries, there are no large capitalists that can take such risks in the beginning. So you recommend these kinds of policies. If you took the neoclassical view, then, basically, economic growth happens ultimately as a consequence of people trading. So as people want to buy better things then they are ready to offer higher prices and entrepreneurs will spot the opportunity, produce new things. In that world, you also assume that technologies are freely available, and therefore everyone has equal productive capability.

So if, for example, countries like Guatemala are not producing things like BMWs, it’s not because they cannot, but because it doesn't make economic sense. You have all these assumptions about the economy, which basically suggests that free trade and free market policies are the best. At most, you would provide some public goods like infrastructure and basic education, but, beyond that, you don't really have to do anything other than keeping competition alive by opening your borders, by deregulating businesses. Competition in the market provides the natural spur to economic growth and whatever happens happens. The government has no business in directing people to set up a steel mill or to start producing electronics equipment and so on. If you keep the markets open and free, economic development naturally follows.

From these two different visions of how the economy works and develops in the long run especially, you’d come up with completely different sets of economic policies.

I: This is extremely interesting. When different economic theories or schools are compared, some express the view that each school might explain some aspects better than others, but that no school is necessarily better than all others. Would you say that, when it comes to development, one approach is more helpful than another?

HJC: Yes. I would say so because some schools were actually designed to understand and promote economic development. So what I call broadly the developmentalist school, which include the older kind of infant industry arguments, as well as the so-called development economics of the 1950s and ‘60s, these were people who were actually trying to understand how economies develop and how this can happen and what kind of policies you need to use. The whole research programme was geared towards the question, so it’s natural that they have developed a deeper understanding of the process. Neoclassical economics is about market exchange. It has developed quite an impressive set of theories and tools to understand that process, but when it comes to production, technologies, the theories are really primitive.

The so-called theory of production in neoclassical economics is a very vague process in which some abstract quanta called capital and labour are combined in some proportion according to some instruction manual called technology. There is really no deep understanding of how a production process is organised, how technologies are developed, how they affect the organisation work and society. The theory was not designed to understand economic development. So it’s natural that the theory doesn't explain economic development very well. In contrast, I don't think that the developmentalist school has a good theory of market exchange as neoclassical economics does because that’s not what it is interested in.

It’s not the only factor but the purpose for which the theory has been developed has a huge influence on what it is good at. Keynesian theory was basically developed to understand unemployment and business cycle and things like that. So they are very good at those, as well as at understanding finance, but on other things, like economic development or consumer choice, it doesn't have as many important things to say as the other schools.

I: A central interest of the developmentalist school is, of course, the role of the state. In one of your books, you argue that if we look at the development process historically, studying how developed countries actually developed, we can see that they used state policies in a strong and targeted way.

HJC: That’s right, yes.

I: But this is in contrast with the received view that free trade is better for development. How would you characterise the role of the state for development and the policies that were used?

HJC: Well, even in developed economies, the state plays a hugely important role. In virtually all countries, it is the single largest employer and it is the single largest organisation. In some countries, public sector employment could account for as much as 25% of the total employment. In some countries, government spending could be equivalent to 50-60% of GDP. So the government is always playing a huge role, but in the early stages of economic development, the government has to play and has played a very important role in transforming the productive structure because if you leave it to the market, very little is going to happen. You will keep specialising in what you already have and it will be very difficult to move up the ladder, if you like, because there are already superior producers with vastly superior technologies, access to the management skills and the marketing channels and skilled workers out there who will immediately wipe you out if you don't have extra protection which can only be provided by the government in those circumstances.

So in the early stages of economic development, virtually all the countries have used state intervention in a very heavy-handed way. This is the case also for countries like Britain and the United States, which most people think were developed on the basis of free trade and free market. In some respects, actually, they were even more interventionist than the states of Germany or France or Japan. It depends on the area of policy you look at, but basically, when it comes to trade protection, these were the most protectionist economies in their respective catch-up periods. In the United States especially, Alexander Hamilton who was the first Secretary of the Treasury or what would be called the Finance Minister in other countries, actually invented the theory of infant industry protection. Between about the 1830s and the Second World War, the average tariff rate for manufactured imports in the United States hovered between 40-60%. Today, for the typical developing country, the tariff rate is 10%, and during this 120-year period, the US was literally the most heavily-protected economy in the world.

Of course, different countries have used different tools and different combinations, in different intensities, but virtually all countries have used intervention as part of their measures. The interesting thing is that when they get developed, they begin to see the world differently. They now realise, ‘We don't need protection. Actually, why do those other guys have protection? We need to dismantle them.’ Then they put pressure on the other countries. They try to persuade other countries to dismantle this protection. This is what the 19th Century German economist, Friedrich List, who is mistakenly known as the Father of the Infant Industry argument, even though he only developed the theory originally invented by Alexander Hamilton, described as ‘kicking away the ladder’.

You climb to the top using a ladder and you kick that ladder away so the other people cannot climb to catch up with you. The pattern is really striking because when Britain was trying to develop its economy from a raw material based economy in the 18th century it used a huge range of protection. When it became the strongest industrial nation in the mid-19th century, it dismantled that protection and put pressure on other countries to follow.

The Americans and the Germans resisted that and used protection but when the Americans became the top dog, they said, ‘we should do free trade,’ although the US never really practised free trade to the same extent that Britain did in the 19th century. More recently, countries like Japan and Korea developed using all those protectionist measures, government subsidies and so on, and now you go to the WTO and various international places, you typically see the Japanese and the Korean government advocating free trade and dismantling of restrictions on foreign direct investment. So, sadly, this pattern of kicking away the ladder keeps happening.

I: Do you think that, at the early stages of development, there might be downsides to the kind of state policies you have discussed?

HJC: Oh yes, of course. My view is that there is no policy that has no downside. All polices have benefits and costs. Basically, you have to make a judgment as to what kind of benefits you are going to get and what kind of price you are going to pay. So the kind of policies that I advocated, in my view, are absolutely necessary. Without it, there would be no economic development, but having those policies does not guarantee success because they carry their own cost. One cost is that these are really long-term investments. It took Japan 40 years of very high protection to make its automotive industry internationally competitive. The Japanese automotive industry was set up in the 1930s and it was only after 40 years of protection, basically a ban on foreign direct investment and massive government subsidies, that Japanese cars became internationally competitive.

So it’s a long game that you have to play, and this makes it risky. Because you are now providing protection in the hope that in 20 years’, 30 years’, 40 years’ time, you will reap the benefit. Lots of things can go wrong. So that’s one problem. Another is that all policies, however general they may look, have winners and losers. Even something as general as monetary policy, well, if the government increases money supply or reduces interest rates, it benefits people with debt. So all policies have winners and losers, but these type of targeted trade and industrial policies that I said are necessary in the early stages of development have clear winners and losers because you are going to support not all debtors but this particular industry or even this particular firm. That makes it very open to political abuse and corruption. So managing that process is quite important.

Of course, this is not to say that you should not use these policies because, if you should never use any policy that carries any risk, then you might as well just die. Why bother living? But you have to be aware that the long-term nature of these policies and the openness to corruption and abuse are there and you have to very carefully think as to how you are going to solve them. Well, not completely solve, I mean, that is impossible, but reduce these problems.

I: You often emphasise that economic development doesn't happen in a political vacuum—that there is a crucial political economy dimension, which is important for understanding why some countries develop and others don't. Do you think that the countries that developed had features in common concerning their internal political situation?

HJC: Yes. The most obvious common feature in developing countries is that -well, not all of them but in most of them- in the early stage of development, the landlords are very powerful. They don't want economic development. They want to be able to export their agricultural products and import the finer consumer goods from the US or Europe. This pattern has always existed.

Look at the United States. Why was the US Civil War fought in the 1860s? Part of it was slavery but another important part was that the north and the south couldn't agree on trade policy. The northern states, which were trying to develop manufacturing, wanted infant industry protection against European imports. The southern states said, ‘This is stupid. We can export our agricultural products using the slaves to Europe and import manufactured products which are much better and cheaper, even considering the transportation costs, than the American ones. Why should we subsidise these inefficient Yankee producers?’

So there was a big tension from very early on and finally, this erupted into the Civil War. It was only because the north won the civil war that the Americans could pursue this protectionist policy with greater force. Some would say that the north won the Civil War only because they had the manufacturing industries that could produce better weapons. The southern states, which were agrarian, didn't have those and had to import them from Europe. They couldn't keep it up. My friend, the Norwegian economist Erik Reinert, once said that, “Latin America is the United States in which the south won the Civil War.” The landlords kept ruling; they didn't want industrialisation. So this is a very typical problem.

Now, of course, this doesn't mean that the landlords are the only problem. If you look at, for example, Brazil or South Africa today, you can see that it is the financiers that are really killing off the manufacturing industries because they want a stronger currency, they want high interest rates.

Manufacturing industries have collapsed in these two countries in the last 20, 30 years because the financiers became dominant and basically, they implemented policies that are very detrimental to the manufacturing industry. Until the late 1980s, the manufacturing sector accounted for close to 30% of Brazil’s GDP. Today it’s 10%. Basically, it is disappearing. That is not the only reason, but the most important reason is this set-up of macroeconomic and monetary policies that have favoured the financial sector and imposed a high interest rate and over-valued currencies on the manufacturing industry.

Now, having said all this, I am not suggesting that these political obstacles can never be overcome. After all, the Americans actually fought the Civil War to resolve this, but you could do it in a more peaceful way. For example, when Otto von Bismarck united Germany, his political base was the big landlords called ‘the Junkers’. The Junkers didn't want protectionism. Well, they wanted protectionism but only for agricultural products. They didn't want industrial protection. On the other hand, at the time in Germany, all these new heavy and chemical industries like steel and pharmaceutical and so on were emerging, and they needed protection. So Bismarck brokered a deal. He created this new political settlement called the Marriage of Iron and Rye, basically giving protection to agricultural products, thereby buying the landlord’s consent to provide protection to heavy industries as well. So you can make these deals.

Sweden had very conflictual industrial relations in the 1920s. It literally was the country that lost the largest number of working days per worker to industrial strikes. It had the worst industrial relations in the world in the 1920s. But in the 1930s, the capitalists and the workers came to some kind of grand compromise and basically started working together, and that accelerated Sweden’s economic development as well as their development of the welfare state.

So, I’m not saying that you need to actually fight a war to change these political arrangements, but yes, that is very fundamental in understanding why some countries are developing and why some are not, because what kind of people are in charge of economic policies really determines how well the economy can develop.

I: There is also an interesting methodological aspect in your approach: it seems to be neither purely based on laws that apply everywhere in time and space, nor purely based on what worked in specific cases.

HJC: That’s right, yes.

I: So it seems that there are some general principles on which development is based, which nonetheless take a different form in each country, depending on the history of that country.

HJC: That’s right, yes. Exactly, yes. You can generalise on everything, but sometimes, that generalisation is completely useless. Sometimes, it may have some use, but, in general, while understanding general principles, you want to understand also the specificities of each society at different points of time in order to fully understand what countries should do in order to develop their economies. So, yes, there are very basic, almost universal principles, like backward economies need some kind of infant industry protection, but exactly what that means in terms of policies will differ very much according to the country’s political condition, its technological base, the education level of the people, what kind of trading relationships that it has with the rest of the world. You really need to study those to be able to make concrete recommendations that are appropriate for the country.

This is why the so-called structural adjustment programmes of the International Monetary Fund and the World Bank in the 1980s and ‘90s failed miserably, because they were basically giving the same recipe to all countries. This is an anecdote, but in those days, when I was a young academic, you would hear these stories about some IMF economist giving a presentation about what the country should do in front of the president of Bolivia and then, oops, in some of the slides he forgot to change ‘Ecuador’ into ‘Bolivia’. Basically, they were using the same template, putting different numbers, different country names. This is not out of laziness, because these people genuinely at the time believed that there’s one correct economic policy. You might need to tweak it a little bit here and there but basically it’s the same policy: open up trade, welcome foreign investment, cut government spending, reduce welfare state, deregulate the markets, especially labour markets, weaken the trade unions, and have a high real interest rate.

The same policy applied everywhere and the result was miserable. So we already know from experience that this overly-generalised policy – what people call the ‘one-size-fits-all approach to economic policy’ – is highly problematic, but, unfortunately, because of the failure to integrate these things into their policy recommendations, a lot of economists ended up giving the same recipe to different countries with very different conditions.

I: The broad framework that you have just discussed was indeed widely criticised. Is a new consensus emerging on development policies? In other words, are there aspects on which many if not most economists currently agree?

HJC: Yes. Well, there was a talk of a Washington consensus in the 1990s because this American economist closely associated with the World Bank and the IMF called John Williamson said that there is this list of 10 policies that the main players in Washington, namely the IMF, the World Bank and the US Treasury agree upon as good development policy. It included liberalised trade, privatised state on enterprises, welcomed foreign investment. So that was known as the Washington Consensus. It got very heavily criticised and then the people came up with this idea of a post-Washington Consensus and Beijing Consensus and God knows what. But I think, unfortunately, in the majority of the economics profession, in the majority of the international organisations, the core still remains the same.

There is, I admit, a greater acceptance of more selective industrial policy of the kind that I recommend, but even people who advocate this, like the former chief economist of the World Bank, Justin Lin, and the Harvard economist, Dani Rodrik, they are very cautious. They say, ‘You can’t just leave everything to the market, but you have to be very circumscribed and careful in making these selective interventions and you should not try to take a big leap,’ like say Korea did in the 1960s when it decided to build a steel mill when its income was only 4% of the US income.

So there is a greater recognition that the original Washington Consensus was flawed, at least in two areas. One is that it advocated the opening of the capital market, which even the IMF these days is saying was a bad idea. Less widely, this recognition that the government might need to do a bit more than what the Washington Consensus recommended in terms of trade and industrial policies. So it’s a bit different now, but other than the capital market openings discussion, I think that the core basically remains the same.

I: Is this debate connected to the intellectual movement that, in the past decades, has been giving more weight to institutions as one of the causes of development? What does this literature mean by ‘institutions’?

HJC: Ah. Well, there is, of course, a debate on what an institution is, but I think that, broadly, people agree that this is basically the rules of the game of a country’s economy and society. So it could include literally everything in a way because even markets, they are built on certain institutions. Every market has rules on who can participate – child labour is banned, slave labour is banned. Every market has rules on how you can behave in that market. There are restrictions on monopoly. There is regulation on consumer protection, worker rights. So, actually, everything is determined by institutions. So, at one level, it becomes almost meaningless to say that institutions are important because everything is based on institutions.

Basically, I think the challenge is to give substance to this broadly correct idea. Unless you look at something very concrete, like, ‘does this way of providing social welfare work better than some other ways?’ ‘Under what conditions would public ownership be more beneficial than private ownership?’ Unless you ask these concrete questions, I mean, these broad statements – institutions are important, property rights are important – become meaningless. Yes, important, but in what kind of ways?

So I think that the literature still has a long way to go because, unfortunately, the more recent institutional literature has been basically about affirming the superiority of private property, more narrowly Anglo-American style private property. There is huge literature on how an Anglo-American style corporate governance system gives you better results and all kinds of stuff, but there are more concrete questions that are rarely asked and even more rarely answered.

I: Property rights are often cited as something that must be guaranteed as much as possible for development to happen. Could there be cases in which, actually, it’s better not to guarantee property rights so much? Would there be cases in which development benefits from lower protection of certain rights?

HJC: Yes. I think the problem with this property rights argument is actually, what do you mean by ‘property rights’? I mean, because there are many different forms of property rights. So, except for, I don't know, totally virgin land where no one used to be there, all assets involve some kind of property rights. You’d think that this forest in the back of some village in India involves no property rights? No. Those are things that very often involve very elaborate rules on who can collect firewood, who can collect mushrooms, when people can go into the forest, when they cannot be allowed to go into the forest. So there are very strong communal property rights. You have Linux and all this software which is free but also involves certain rules. You are not allowed to use these sharewares, develop commercial software and earn profit. You cannot use this common property to make profit for yourself.

So there are rules there. People who say, ‘you have to protect property rights’ usually do not understand this. When they say, ‘property rights’, they only think of very narrowly-defined private property rights and then they ignore everything else. That’s one very big problem, but an even bigger problem is that this view that the strongest possible protection of the existing property right is the best. If you believed in that, we should still all be living in feudalism. You should have protected feudal property rights as strongly as possible. You started destroying that and then you built capitalism, so are you against capitalism? Of course, Karl Marx already had great theories about the evolution of property rights system - in his words, ‘relations of production’. Basically, the property rights systems evolve and interact with technologies and there might come a time when these technologies outgrow the existing property rights and you need new property rights.

There are a lot of instances in history in which radical changes to property rights are supposed to have benefited economic development, even though they might also have destroyed a lot of lives. The enclosure in Britain that vastly increased the production of wool by, basically, privatising the common grazing land, the abolition of slavery in the United States, land reforms in Japan, Korea and Taiwan following the Second World War – these are all things that have greatly benefited subsequent economic development, but, according to this ‘protect property rights to the maximum’ school, these things shouldn’t have been done.

I: This is an interesting argument. You seem to suggest that institutions can be changed through policies, but in order for them to be conducive to development, one needs to take into account the context. Hence, for example, it is difficult to devise a one-size-fits-all approach to property rights.

HJC: Yes. That’s right. My view is that the most effective way to change institutions is to change the underlying material conditions. In this respect, I am very Marxist. Basically, institutions are going to be changed to fit the underlying material conditions. Without those conditions, you can make some changes, but it’s impossible to fundamentally change institutions.

For example, take the case of these informal institutions that say that boys are better than girls. Basically, almost all agrarian societies have that rule because in agrarian societies, without machines, muscle power is the foundation of wealth. If you have a lot of strong sons, your family farm grows, otherwise you die. So it’s natural that a son preference develops in those societies. In those societies, whatever you do in terms of public education and media campaign and legislation, this is not going to go away.

This will disappear only when you have fundamental change in the occupational structure, which comes from fundamental change in the production structure that means that now a brain counts more than muscles. Then girls are usually smarter, so women have higher status. Once you have this material condition, of course, even then these old prejudices do not disappear quickly, but once you have that condition, education programme, media campaign, these are going to be much more effective. If you don't have that material condition, forget about it.

I: This interview series aims to relate specific strands of economics research to the existence of different schools and traditions in economics research and teaching. You have already mentioned the importance of economics schools, for example, for different definitions of development. Do you think it’s important for a researcher or policy-maker working on development issues to be aware of what school they’re working in—or even of the fact that different schools exist? Do you think that this kind of awareness is important?

HJC: Oh, absolutely, yes, because, as I said earlier, how people conceive economic development and what kind of policies they recommend to achieve it and how they would like to balance it with other goals in human life, these are all fundamentally affected by the theoretical framework they are working with. So if you are a politically progressive neoclassical economist, you might be inclined to promote growth-maximising policies, combined with some kind of greater redistribution to the poorest people, and then you will come up with certain kinds of policies. But if you are working from the developmentalist tradition where we say, ‘Policies that bring quantitative growth in the short run may actually harm qualitative growth in the long run. We pour more resource into producing more coffee, more palm oil, today we might have higher income, but this will deprive resources from other more productive sectors like electronics and machines and so on and we cannot let that happen. Then we need to change these market incentives for more resources to go into these other things.’ Then that person might also say, ‘These marginal redistributive policies, of course they are better than nothing, but unless you fundamentally transform the economy so that people do more productive jobs and have higher salaries, these are not going to lead people out of poverty.’ Then you will have very different kind of recommendations. So even if both of these guys are in some sense progressive politically, they might have completely different recommendations, and these come from basically their different theoretical framework to understand economic development. Now, I’m not saying that one is necessarily completely superior to the other, but people need to be aware of what they are recommending and why.

I: How do you think we can create awareness of the existence of different economics traditions? Is it something that starts with university teaching, or is it something that should happen during professional development?

HJC: I think these things should be taught as early as possible. In an ideal world, you want to make the History of Economic Thought compulsory for undergraduate students, although that is not going to happen in most universities. Once you are drilled in one school as the school, the scientific school, even if ten years down the line you are told, ‘By the way, there were these other guys like Marx and Keynes and Schumpeter,’ you will not be receptive to these different ideas because your ideas have already been congealed. You are operating in a particular framework. You would have already been taught that, ‘Well, there was only one type of economics, so these people must be sociologists or historians. I don't need to learn them.’

So I think it’s very important that people are exposed at least to the existence of these alternative schools. Now it doesn't happen anymore but in the early 2000s, I would occasionally meet American students who have never heard of Keynes. In America, late ‘90s, early 2000s when this neoliberal economics was at its height, they stopped teaching Keynes, even to criticise him. They’d never heard of Keynes. So when you get that kind of education, you are going to develop a very narrow-minded view. Even if you are told later that there are all these other things, the chance of you absorbing those ideas is very low.

I: Do you think it is also important to expose economics students to the work of other social scientists and historians?

HJC: Oh yes, absolutely. Unfortunately, we have seen what some economists call ‘economics imperialism’, in the last two or three decades. So basically now, economists are saying that, ‘We can explain everything. Sociology, Anthropology, these are all inferior versions of what we do.’ For instance, they apply rational choice theory to understand problems that have typically been researched so far by sociologists, anthropologists, political scientists and historians. They may be able to highlight some interesting aspects that these other people have missed out, but that is not to say that the economists’ explanation is superior. It’s new. It might be, sometimes, original, but it’s only a partial explanation.

So you need to actually work in an interdisciplinary way to collaborate with the other researchers to get new perspectives, to learn about the limitations of your own approach and also to teach them what limitations their approaches have. Only when we do that we can have a full understanding of the world because all theories have particular ways of understanding the world. All theories have particular ethical and political assumptions. All theories have their own special jargon and analytical tools and so on. Of course, individually, we have to specialise, but unless collectively we pull them all together, we are not going to have a full picture of the world. At the moment, things are really bad because, even within economics, they would not accept that there are nine, ten, fifteen different ways of doing economics.

When it comes to other social sciences or history of other cognitive subjects, their attitude is positively revolting. ‘We are superior. Sociologists, Anthropologists, these are inferior people.’ That makes you very narrow-minded and very blinkered in your view. So, yes, the more openness to different approaches, both within economics and beyond, that’s what we need to teach the students.

I: One last question. How were you taught economics and how did you develop an interest in different schools?

HJC: That’s interesting. I studied economics in the early 1980s in South Korea. Most of our professors were neoclassical economists, although, compared to today’s neoclassical economists, they were much milder. But the reason why I started looking at other approaches was because I just couldn't reconcile what I was taught in the classroom with what was happening around me. At the time, South Korea was going through its miracle growth period. The economy was growing at 8, 10, 12% every year, massive social transformation, positive and negative, and huge conflicts. Workers going on strike, students going on demonstration, riot police coming in to bash people. Huge conflict, and then in the classroom, the professors were saying, ‘All changes are marginal. Everything is in equilibrium.’ I couldn't take it seriously.

So I started looking around to see whether there were other things and yes, luckily at the time we still had a few old professors who were institutionalists of the old kind and had some Marxist influence. So I realised that there were these other things. It wasn't just me. Many of my friends were looking for answers that they were not getting in the classroom. So we were all reading different things and studying different things and then I decided to come and study in Cambridge, which at the time had a huge range of different non-neoclassical economists. Of course, the majority were Keynesian, but there were other people with influences from Marx and the Austrians and whatnot. So, yes, when I got here, I got to see an even broader horizon, and that made me very aware that there isn’t just one approach, there isn’t an approach that is superior to all the other approaches on everything, and that has made me a pluralist.

I: Is there anything you would like to add?

HJC: No. I talked too much!

I: Thank you very much for the interview.

HJC: Thank you.

(End of recording)